Business

Unlocking the Secrets to Building an Entrepreneurial Empire: Lessons for Aspiring Business Leaders

Key Takeaways

- The entrepreneurial mindset is foundational for enduring success.

- Effective market research primes the ground for recognizing valuable opportunities.

- Financial mastery is a crucial element of entrepreneurial growth and stability.

- Strategic planning and brand development are critical pillars in business evolution.

- Adopting ethical practices and social responsibility is becoming increasingly significant.

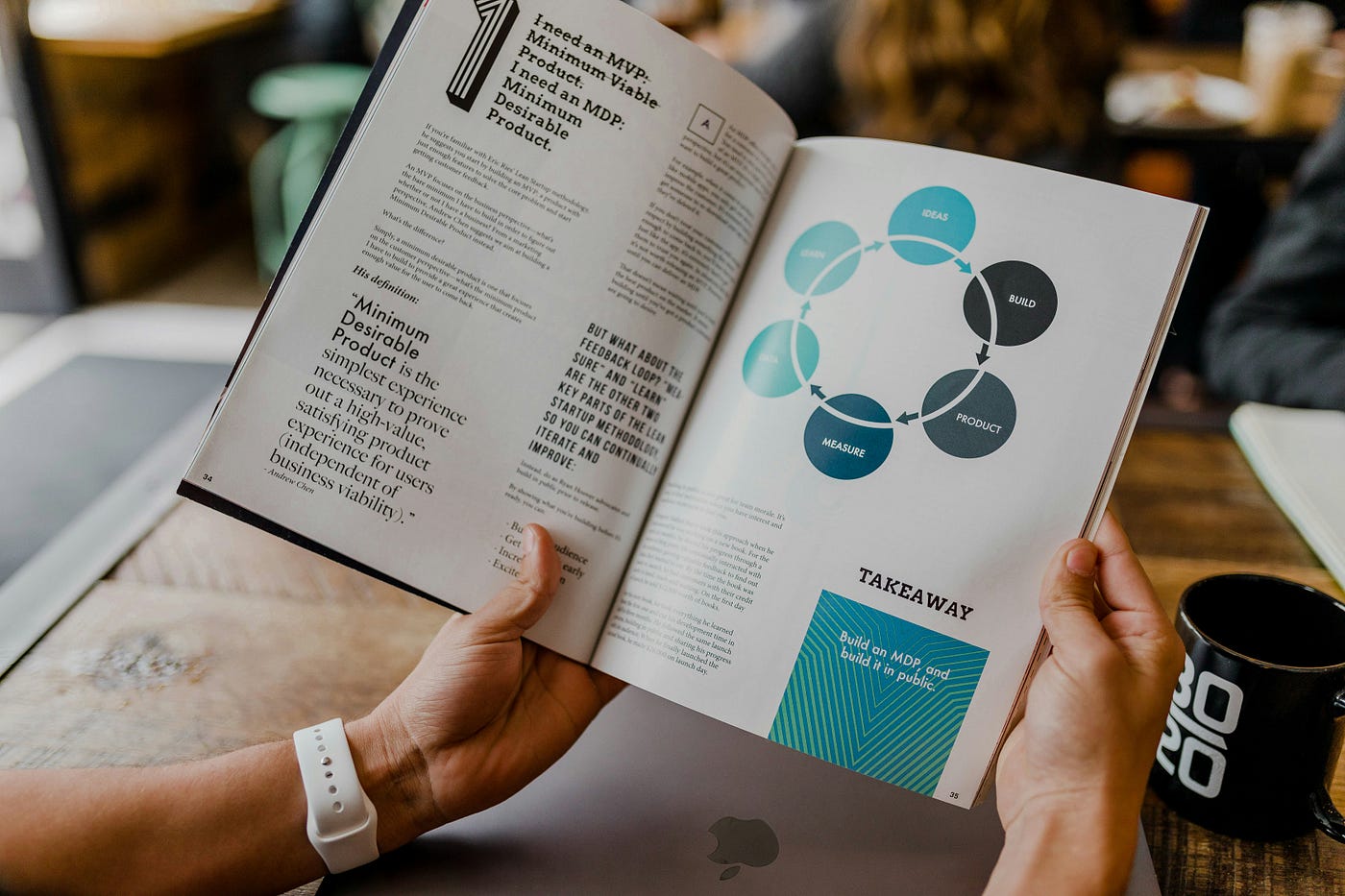

Success is often envisioned as the ultimate destination for those drawn to the entrepreneurial journey. However, the road to building a lasting business empire is intricate and demands a unique blend of tenacity, insight, and a bit of luck. Aspiring business leaders look for proven strategies and lessons from those who have trodden the path before them, such as insights from Larry Gaynor’s book “Take A Chance” which encapsulates the entrepreneurial spirit and illuminates a pathway for success.

This article compiles essential lessons and strategies to assist aspiring and established entrepreneurs in navigating their way to the pinnacle of their business endeavors. We share universal principles from collective entrepreneurial wisdom to build a robust foundation for an entrepreneurial empire.

The Entrepreneurial Mindset

Entrepreneurs who succeed in creating lasting empires often possess a particular set of mental attributes, including resilience, a clear vision of the future, and the adaptability to embrace or initiate change. Cultivating an entrepreneurial mindset requires an inner conviction that growth and learning are continuous processes. It also necessitates comfort with ambiguity, an openness to take calculated risks, and an unwavering commitment to one’s entrepreneurial vision. While entrepreneurial skills can be learned, the mindset is often honed through experience and reflective practice.

Identifying Market Opportunities

The genesis of many entrepreneurial successes can often be traced back to identifying a latent need or an unaddressed market demand. Entrepreneurs must develop a keen eye for spotting shifting market trends and be adept at conducting comprehensive market research to unearth these opportunities. It is about more than just recognizing what needs to be added to the market; it is also about predicting what customers may desire. Once identified, these opportunities become fertile ground for launching innovative solutions or products that can disrupt the market and set the stage for a successful entrepreneurial venture.

Financial Acumen for Entrepreneurs

At the heart of every successful entrepreneurial venture lies a sound financial strategy. Whether bootstrapping a startup or navigating the complexities of venture capital and investor relations, entrepreneurs need to be well-versed in the economic aspects of business. This includes understanding cash flow management, capital allocation, and investment strategies that can fuel growth without sacrificing the business’s financial health. It’s also essential for entrepreneurs to be prudent in their spending, particularly in the early stages, to ensure that the company remains on a sustainable trajectory.

Strategic Planning and Execution

While an inspiring vision is a critical component of entrepreneurship, translating that vision into a tangible strategic plan turns aspirations into reality. A robust business plan outlines not only the vision and mission of the enterprise but also sets forth actionable goals and strategies. However, it is the acute execution of that plan that determines success. Successful entrepreneurs understand that while plans may serve as a roadmap, the agility to adapt and the ability to pivot in response to unforeseen challenges truly drive progress.

Building a Strong Brand

A brand is more than a name or logo; it represents a business’s identity and values. Strong branding can engender customer trust and loyalty, creating a sustainable competitive advantage. To build a strong brand, entrepreneurs must invest in telling their stories, delivering consistent quality, and forging emotional connections with their target audience. Effective branding is a strategic effort that leverages tools like social media strategies to create a recognizable and respected presence in the marketplace.

Leadership and Team Building

The role of leadership in entrepreneurship cannot be overstated. Entrepreneurs must lead by example, inspire their teams with a compelling vision, and cultivate a workplace culture that reflects the ethos of the business. Successful entrepreneurs understand that their employees are the most valuable asset and that building the right team is critical to the company’s success. This involves strategic hiring practices, fostering professional development, and creating an environment where innovation is encouraged and rewarded.

Scaling the Business

When a business is ready to scale, entrepreneurs must plan carefully for growth. Scaling requires a nuanced understanding of the business’s current position and a strategic plan for moving forward. This might involve diversifying the product lineup, entering new markets, or optimizing internal processes for efficiency. Successful entrepreneurs know how to manage the risks associated with scaling, ensuring that growth does not compromise the quality of the product or service or the business’s core values.

Learning from Failures

Failure is a natural part of any entrepreneurial journey. However, successful entrepreneurs distinguish themselves by their responses to these setbacks. Instead of allowing failures to impede progress, they leverage them as opportunities for learning and improvement. Reflecting on missteps and extracting lessons from them is a fundamental process that strengthens an entrepreneur’s ability to navigate future obstacles and informs better decision-making.

Staying Ahead of the Curve

Entrepreneurs must stay abreast of industry trends and technological advancements to remain competitive in a fast-paced business environment. A commitment to continuous learning and innovation ensures that a business remains at the forefront of its industry. Entrepreneurs who cultivate thought leadership and seek out knowledge across a range of disciplines are better equipped to anticipate changes in their market and respond proactively to shifts in consumer demand.

The Bigger Picture: Ethics and Social Responsibility

Today, consumers and stakeholders are increasingly holding businesses accountable for their impact on society and the environment. Ethical entrepreneurship and social responsibility are no longer mere buzzwords but critical components of a modern business strategy. Entrepreneurs who embrace these principles find that doing good can also benefit business. By aligning business operations with ethical practices and corporate social responsibility, companies can build trust, enhance their reputations, and contribute positively to society – all of which can contribute to the longevity and success of the entrepreneurial empire.

Final Reflections

Building an entrepreneurial empire is as much an art as a science. It requires keen insight, strategic planning, and an unwavering commitment to ethical values. The lessons and strategies outlined in this article provide a blueprint for those aspiring to leave an indelible mark in the business world. By applying these principles, entrepreneurs can navigate the complex journey of building a successful and impactful business that stands the test of time. As we look to the future, let us embrace these lessons with the spirit of continuous learning and growth that defines the entrepreneurial way.

Business

Lead Generation: How Much Does it Cost?

Lead generation is the lifeblood of any growing business. Everything is geared towards drawing in prospects, and you need them for your business to grow. Yet the costs behind lead generation can be a bit of a mystery. Usually, the prices are driven by some factors, so it can be pretty expensive.

How Do You Determine the Cost of Lead Generation?

Before you begin finding leads, you need to think of it’s cost. This will help you in your decision. Here are some of the things that can influence how much leads cost:

Industry and Target Audience

Lead generation cost is heavily dependent on the particular industry and who you are targeting. For example, in highly competitive finance or technology markets, leads will be more expensive. The reason is that they are in high demand, and the market is saturated. On the other hand, lead generation costs may be cheaper in less competitive markets. So, it’s important you know your industry and how accessible the target audience is to help you estimate the costs of generating leads.

Lead Generation Methods

The methods that you use to acquire leads will, in large part, dictate the amount. To be specific, buying a lead list can cost anywhere from $500 to $2,000 per 1,000 contacts, which is expensive. However, if you invest in some tools, it can help you save money. There are sales tools that can cut time and are effective in generating leads.

Technology and Tools

As mentioned earlier, there are some advanced technologies and tools that may have an impact on the cost of your lead generation. Aside from the monetary cost of the tools, you will need to make sure they are up-to-date. Also, it will require training and integration with other resources for it to actually benefit you. So, it is important to weigh the benefits over the cost. The goal should be how it will help achieve your lead-generating goals.

Final Thoughts

In summary, there is really no such thing as a lead generation cost. It will vary on the industry and the tools you’re using. So, your focus should be on what will work best to meet your business objectives. Also, consider how you can create a cost-efficient lead generation plan with the highest returns.

Business

7 Tips to Reduce the Environmental Impact of Product Deliveries

With the rise of e-commerce and fast deliveries, the environmental impact of logistics has become a major concern. Every day, thousands of trucks, vans, and scooters take to the roads, producing CO₂ emissions, contributing to urban congestion, and generating significant amounts of waste, particularly through packaging.

But here’s the good news: solutions exist to mitigate this impact! By adopting more sustainable practices, businesses and consumers can help reduce the carbon footprint of deliveries while meeting growing demand.

In this article, discover 7 practical tips to make product delivery more environmentally friendly, and learn how these changes can make a real difference for our planet.

I. Why Reducing the Environmental Impact of Delivery is Crucial

The Environmental Impact of Deliveries

With the growth of online shopping, product deliveries have significant consequences for the environment. Key impacts include:

- CO₂ Emissions: Vehicles used for transport, often running on fossil fuels, contribute significantly to global warming.

- Urban Congestion: In cities, delivery trucks and vans increase traffic, leading to more pollution and noise.

- Packaging Waste: Many deliveries come with excessive cardboard, plastic, or filler materials that end up as waste.

Key Figures Highlighting the Issue

- Deliveries account for nearly 30% of greenhouse gas emissions from road transport.

- In France, 25% of vehicles in major cities are delivery vehicles, increasing local pollution and noise.

- The production and disposal of delivery-related packaging generate tons of non-recycled waste every year.

The Benefits of a Sustainable Approach

Adopting responsible logistics practices provides tangible benefits:

- Carbon Footprint Reduction: Using eco-friendly transport or optimizing routes helps limit greenhouse gas emissions.

- Customer Loyalty: More and more consumers prefer to support environmentally conscious businesses.

- Regulatory Compliance: Reducing logistical impact ensures adherence to future environmental standards and avoids potential penalties.

Reducing the environmental impact of deliveries is not just an ethical question; it’s a necessity for building a more sustainable and resilient logistics system. Let’s dive into the 7 practical tips for effective action.

II. 7 Practical Tips to Limit the Environmental Impact of Deliveries

1. Choose Eco-Friendly Transport Modes

Conventional vehicles, such as diesel or gas trucks and vans, are among the top contributors to CO₂ emissions from delivery.

Use electric or hybrid vehicles for urban deliveries. For shorter distances, cargo bikes are an excellent, silent, and non-polluting alternative.

2. Optimize Routes and Consolidate Shipments

Poorly planned routes increase mileage, costs, and emissions.

Invest in planning software to group orders and optimize routes. Additionally, consolidate deliveries by partnering with other businesses serving similar areas.

3. Promote Pickup Points

Individual deliveries increase fuel consumption and unnecessary trips.

Group packages at pickup points or automated lockers, reducing trips and allowing customers to retrieve their orders conveniently.

4. Minimize Excess Packaging

Each order often comes with excessive packaging, contributing to unnecessary waste.

Opt for biodegradable, reusable, or minimalist packaging. Eliminate redundant layers, such as oversized boxes or unnecessary fillers.

5. Offer Deferred Delivery Options

Express deliveries require quick and often inefficient routes, increasing environmental impact.

Provide deferred delivery options that allow grouping multiple orders and optimizing routes.

6. Educate Your Customers

Consumers are not always aware of the environmental impact of their delivery choices.

Share clear information about the ecological impact of delivery options and encourage sustainable alternatives like pickup points or green delivery options.

7. Measure and Offset Your Carbon Footprint

Regular analysis of your activities’ impact identifies areas for improvement.

Track CO₂ emissions and participate in carbon offset programs, such as reforestation or sustainable project funding. For example, using a Dusseldorfer 600×800 pallet in pooling systems can enhance efficiency and sustainability.

By adopting these practices, you reduce the environmental impact of your deliveries while strengthening your eco-friendly image with customers. Let’s now explore the long-term benefits of a responsible logistics approach.

III. Towards Sustainable Logistics: The Benefits of a Responsible Approach

1. Reduced Environmental Impact

Adopting sustainable delivery practices helps reduce CO₂ emissions and waste generated by packaging. This directly contributes to combating climate change and conserving natural resources.

For example, a company using cargo bikes for city-center deliveries can lower greenhouse gas emissions by 30 to 50%.

2. Increased Customer Loyalty

Consumers are increasingly sensitive to companies’ environmental commitments. Offering eco-friendly delivery options enhances your brand image and attracts customers who care about sustainability.

According to a study, 75% of customers prefer buying from eco-conscious companies, even at a slightly higher cost.

3. Anticipation of Future Regulations

Environmental regulations are becoming stricter, particularly in the transport sector. Adopting eco-friendly practices now ensures compliance with future standards and avoids penalties or restrictions.

It’s also a great way to demonstrate your commitment to responsibility to your customers and partners!

4. Long-Term Cost Savings

While some measures require initial investments (electric vehicles, planning software), they reduce logistical costs over time through route optimization and resource sharing.

Reducing mileage and grouping deliveries at pickup points lowers fuel consumption.

5. Contribution to a Circular Economy

Transitioning to sustainable logistics promotes practices such as recycling packaging or pallet pooling, aligning with circular economy principles. These initiatives reduce waste and maximize resource use.

For example, reusable pallets, like the Dusseldorfer 600×800 pallet, allow multiple rotations, reducing waste and enhancing efficiency.

Conclusion

With the rise of product deliveries, reducing their environmental impact is essential, not only to protect our planet but also to meet the growing expectations of consumers. By embracing sustainable practices like eco-friendly transport, route optimization, or packaging reduction, you can align logistical efficiency with environmental responsibility.

These efforts don’t just benefit the environment: they boost brand image, foster customer loyalty, and ensure future regulatory compliance. By committing to sustainability, you help build a more virtuous logistics model while securing your business’s longevity.

Now it’s your turn: every initiative counts in transforming the delivery world into a more planet-friendly system!

Business

Scaling Your SEO: Outsourcing for Growth

Key Takeaways

- Outsourcing SEO can significantly enhance your online presence.

- It’s essential to choose the right partner for SEO outsourcing.

- Measuring success involves key performance metrics like organic traffic.

Table of Contents

- Understanding Outsourcing SEO

- Benefits of Outsourcing SEO

- Choosing the Right Partner

- Key Strategies in Outsourcing

- Measuring Success in SEO Outsourcing

- Common Missteps and Solutions

- Future Trends in SEO Outsourcing

- Final Thoughts on Outsourcing

Understanding Outsourcing SEO

Outsourcing SEO has become a strategic choice for businesses aiming to boost their digital footprint without straining internal teams. This strategy involves hiring specialized third-party firms to manage search engine optimization tasks, including content creation, keyword analysis, and backlink development. Such comprehensive services are essential for businesses striving to maintain an edge in an ever-competitive digital landscape. Leveraging outsource link building services is smart for organizations lacking in-house SEO expertise but still aiming to achieve high search engine rankings and organically increase visibility.

Benefits of Outsourcing SEO

Opting for outsourced SEO solutions brings multiple advantages, such as cost savings and access to expert insights that might need to be more readily available within your organization. By outsourcing, companies can allocate resources more efficiently while gaining the competitive advantage of expert-led SEO initiatives. Furthermore, outsourcing provides access to up-to-date advanced SEO strategies, which may include the latest algorithm adjustments and innovative optimization techniques, ensuring that businesses stay ahead of the curve. It allows companies to focus on core operations while enjoying enhanced online performance.

Choosing the Right Partner

The success of SEO outsourcing largely depends on selecting the right partner. This pivotal decision requires evaluating potential collaborators based on their track record, understanding of your industry, and ethical practices. A trustworthy partner will guide you through technical challenges and align their strategies with your business goals. As SEO approaches require customization for different sectors, opting for a partner with industry-specific experience can be particularly beneficial. Businesses can forge partnerships that enhance online visibility and drive growth by conducting thorough research and seeking client testimonials.

Key Considerations

- Prior experience in your business sector

- Transparency and adherence to ethical SEO practices

- Client testimonials and track record of success

Key Strategies in Outsourcing

A successful outsourcing strategy begins with defining clear objectives and aligning them with your SEO goals. This foundational step ensures that in-house teams and outsourcing partners are on the same page. Frequent check-ins and updates keep the project aligned and adaptive to business priorities or search engine algorithm changes. A robust SEO strategy also incorporates diverse techniques such as link building, content marketing, and technical auditing. These integrated actions create a comprehensive, resilient approach to SEO that considers every aspect of a website’s performance and presence.

Steps for Success

- Define clear, achievable goals suitable for your business scale.

- Maintain consistent communication channels with your outsourcing partner.

- Adopt a mix of white-hat SEO techniques.

Measuring Success in SEO Outsourcing

Tracking the effectiveness of your outsourced SEO initiatives requires a strong focus on specific performance metrics. Analyzing organic traffic, search engine rankings, and conversion ratesprovides insight into the strategy’s effectiveness. Regularly reviewing these metrics evaluates the current performance and helps fine-tune the SEO strategy as needed. Recognizing improvements in page performance and user engagement is crucial to ensuring that your SEO efforts translate into tangible business growth. According to Forbes, these key performance indicators are indispensable for informed decision-making in digital marketing.

Common Missteps and Solutions

Despite best efforts, common pitfalls such as misjudging partners or overlooking analytics can hinder the success of outsourcing SEO tasks. Avoiding these issues involves conducting thorough partner assessments, maintaining regular performance reviews, and adjusting strategies as necessary. It’s essential to stay informed about the latest trends and algorithm changes to keep your SEO approach effective and compliant. Regular audits will help identify and address any disparities between expected and actual outcomes, ensuring your investment in outsourcing continues to yield positive results.

Future Trends in SEO Outsourcing

The landscape of SEO outsourcing is rapidly evolving with new technologies and methodologies. Emerging trends such as AI-driven analytics and more personalized SEO strategies promise to play a significant role in future SEO practices. Staying ahead means embracing these innovations and integrating them into existing workflows. Moreover, companies must adapt to changes in consumer behavior and search engine algorithms to maintain relevance and competitiveness. The future of SEO outsourcing lies in leveraging technology to deliver highly customized and effective SEO solutions.

Final Thoughts on Outsourcing

Outsourcing SEO can provide a significant competitive advantage, helping businesses navigate an evolving digital landscape efficiently. Companies can ensure their SEO efforts are fruitful by strategically selecting partners, clearly defining objectives, and continuously monitoring performance. With the right approach, outsourcing becomes a powerful tool that enhances a company’s online presence and supports sustainable business growth.

-

News1 year ago

News1 year agoVaping: Beyond the Hype – Unveiling the Risks and Realities

-

Entertainment2 years ago

Entertainment2 years agoUnleashing Geekdom: Exploring the Wonders of Geekzilla Radio

-

Fashion2 years ago

Fashion2 years agoWhat is λιβαισ? A Complete Guide

-

News2 years ago

News2 years agoThe Travel Resorts of America lawsuit (Legal Controversy)

-

Games2 years ago

Games2 years agoHow To Play Baduk game: Unveiling the Art of Strategic Brilliance

-

Life style1 year ago

Life style1 year agoDemystifying λυσασ: Unveiling the Enigmatic Concept

-

News2 years ago

News2 years agoAbraham Quiros Villalba: Unveiling the Journey of a Visionary

-

Tech1 year ago

Tech1 year agoUnlocking the Secrets of 02045996875: UK’s Unique